Flagstar Bank

Black, Indigenous, and People of Color Grant

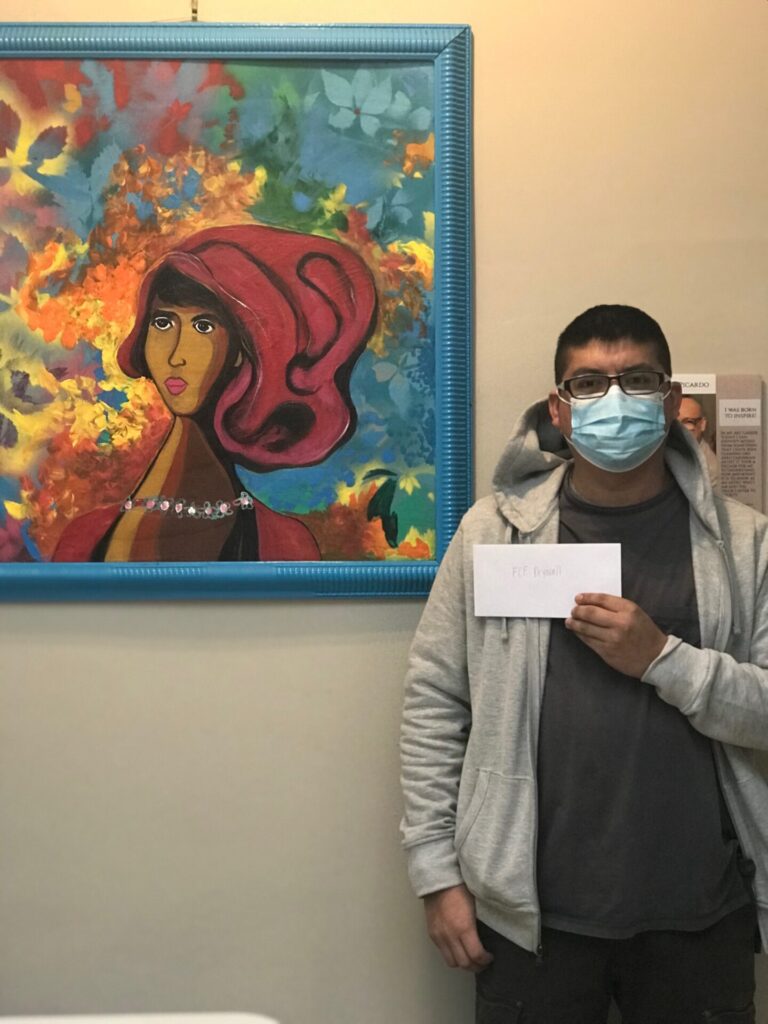

Flagstar Bank & WMHCC BIPOC GRant Recipients

A & J Restaurant Inc

B&G Invest LLC

Caldos El Giro

Dumpster Divers, LLC

E&M Construction Drywall

Exclusive Finish Solutions

FCF Drywall LLC

G & R Cleaning Services

Grand Valley Appliances Heating & Cooling, LLC

Inclusive Empowerment Services

Mendez Carpeting

Mi Segunda Casa Daycare

Sno Shack, LLC

Vida Salon

The Hispanic Chamber partnered with Flagstar Bank to provide $5,000 grants to small businesses.

About the Program

Flagstar Bank’s grant program purpose is to help for-profit small businesses in the key markets of Indiana (South Bend and Fort Wayne); California (High Desert of San Bernardino County) and Michigan that have been affected by the COVID-19 crisis with their operating expenses.

Goals of the Program

To provide immediate financial support to BIPOC small businesses and entrepreneurs in Flagstar Bank’s market areas of Indiana, Michigan and California.

Timeline

There was one round of applications for this program. Funds were distributed to selected businesses during December 2020.

Applications went live: November 9

Applications due: November 20, by 5p.m.

Applicants notified of grant decisions: December 4

Eligibility Requirements

The following is a list of grant criteria and eligibility requirements:

- Grant amounts are $5,000 per business.

- Businesses with annual revenues no more than $1 million.

- Businesses must have been in existence a year or longer.

- Businesses must be for-profit.

- If a business owner operates more than one business, only one application for a single business will be accepted.

- The business name on the application must match the records with the State, County and City. Your business must be in good standing with the State, County and City.

- Certificate of Good Standing.

- The business must have a business address in the Flagstar Bank’s key geographies of Michigan, Indiana (South Bend and Fort Wayne) and California (High Desert of San Bernardino County).

- Grants may be used to cover the day-to-day operating expenses of the business, such as rent, working capital, payroll, utility bills or losses due to destabilizing events, etc. Grants may be used for transitioning to e-commerce, curb-side pick-up, delivery integrations and other creative solutions to increase revenue.

- Agree to share financials and other essential information.

- Agree to share change in business as a result of the grant funding.

What businesses are NOT eligible to apply?

- Businesses that are franchises and chains are not eligible to apply.

- Only socially acceptable businesses – no liquor stores, cannabis, etc.

- Independent contractors operating multilevel or network marketing businesses (such as Avon, Mary Kay, 5LINX, Pampered Chef, etc.) are not eligible to apply.

- Independent contractors working on gig platforms (such as Airbnb, Fiverr, Uber, Lyft, Instacart, etc.) are not eligible to apply.

DISCLAIMER

The information contained herein is subject to the actual grant award documents and the written terms and conditions of which may be amended from time to time. West Michigan Hispanic Chamber of Commerce also reserves the right to make the final determination of any person’s or organization’s eligibility and/or qualifications for program benefits and to make allocation of program benefits as it may, in its sole discretion, deem appropriate.